321 Crack Spreads Bloomberg

Holding Out?Thinking of waiting a while longer to see what other manufacturers offer over the next year? Apple mac sale. Eye Care blue light filter. If you feel like you can’t compromise on a 4K resolution but are open to saving some cash by skipping the USB-C connectivity, LG has a compelling than the price of other displays at under $300. Anti-glare finishASUS Designo is available on.

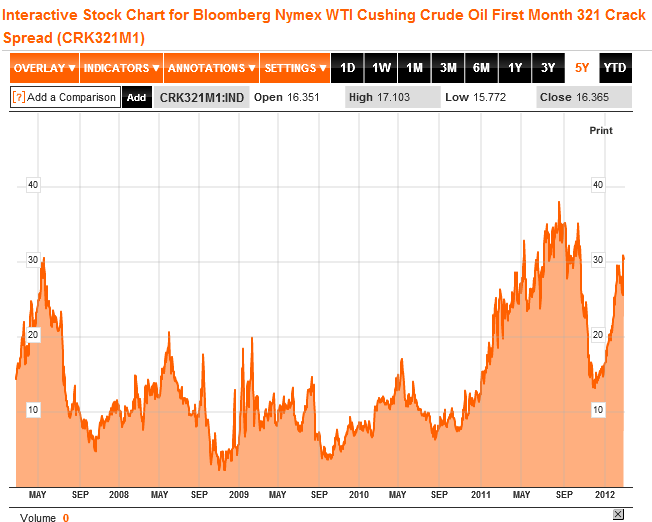

Historically, the WTI Cushing 3-2-1 crack spread was higher than the Brent Crude 3-2-1 Crack Spread because U.S. Producers were not allowed to export crude except to Canada and the price of WTI crude was depressed. However, as the cost of crude fell around the world and the export ban was lifted, crack spreads converged.

Related Discussion ForumMessagesAs a ValueForum member, this section would contain CRACK321 message board posts where theticker symbol CRACK321 has been mentioned by ValueForum members in posts.- we hope you will consider joining ValueForum or trying out our service with a 24 hour trial pass.' ValueForum is an active, private, online discussion communityfor stock & bond market investing. In discussion forums divided into finely grained topics, you will find sophisticatedinvestors trading tips, research, and due diligence on value stocks, income investments, forex, market news,and more.

Join in - trade ideas, strategies, current news, via our unique message bulletin boards,stock ratings system, and other online tools specifically geared toward our community.' Random member testimonial: 'I joined almost three years ago and have never been sorry. The search features here are terrific.'

Nothing in is intended to be investment advice,nor does it represent the opinion of, counselfrom, or recommendationsby. ©2003 - 2020, Powered in part byStock Market Investing Forum - Trading Tips & Research - Online Message Boards.

Bone said:Mav, I hear what you’re saying about particular aspects of the energy space. I spend a lot of effort with clients talking about the volatility risks associated with refined distillates, precious metals, Cotton, and a few other examples. More.So here is what I would say regarding trading flat price vs spreads. I think in a way for complete newbies, flat price is easier in the sense that they 'see' the risk.

This forces them to trade smaller and also not to be shocked by it. For example, say they traded CL. They could look at a weekly range and see it's about 3 dollars and say OK, if I get short this thing here, I should expect to take about 3 pts of heat on a swing trade. It shouldn't surprise them. If they short a calendar spread and apply the same logic, they might say ok, the avg weekly ranges for this calendar is about 10 ticks so I should expect that much heat and they size accordingly. Then some 'fundamental' news comes out that doesn't move flat price that much but blows out the calendar for 100 ticks.

Now you and I would probably be aware of this but it's a common trap for a newbie.In general, all traders I think should move towards spreads as they become better traders. My belief behind this is that if one really has an edge in something, anything, then capturing that edge becomes a lot easier when you can constrain the noise variance from flat price. This is one of the reasons why relative value is such a big hedge fund strategy whether you are a long/short equity fund that is trying to strip out the overall movement of the S&P 500 or you are an options trader who wants to take a vol position while stripping out the directional movement of the underlying or taking a position on the yield curve where you want to be agnostic to the absolute direction of rates and focus more on the shape of the curve.Everyone should be moving towards that goal in my opinion. However, that comes with time and skill and experience. I think Overnight is a good example of someone who tried to move from flat price trading of CL into weird spread configurations without the requisite knowledge of what he was trying to do.

I noticed on a few older threads he started regarding oil I tried to have this dialogue with him regarding some basic fundamentals of oil that he seemed to have backwards. For those of you reading this thread for learning purposes the reason we trade spreads over direction is because it allows one to explicitly express their views on fundamentals. Flat price does a terrible job of capturing fundamental movements in commodities. In my opinion I think flat price is probably read better with charts and momentum type studies while spreads tend to respond to real fundamental concerns. And yes Bone, you are correct in that price has those fundamental views embedded in the chart.

However the idea is to understand why the market is pricing the fundamentals the way they are not to simply just accept it. This allows one in my opinion to better trade against them if you disagree. Bone said:Let me talk for a minute about 'platforms'. Newbies obsess way too much about platforms.

I used CQG for 16 years straight and was shamed by clients into using something cheaper. I was also spending about $250 per month on business broadband $800 per month on CQG charting along with $1800 per month for a TT Pro license. For me it was akin to leasing a FULL seat six of one half dozen of the other.eSignal sucks. I really dislike it.

But I use it because it charts ALL of the exchange spreads (literally thousands of them) - and because it makes no sense for a client to spend several thousand dollars needlessly on real time data and for questionable functionality while they are training with me. Since we emphasize spread construction and modeling - we don't even get live data. If you want live data you can look at your execution platform or call your FCM's execution desk. We're swing trading so for us it's not an absolute must.My point is this: learn the whys and hows before you obsess about executing the trade. More.It's unwieldy.

The market scanning and monitoring function does not allow for much customization in terms of indicator packages and even more specifically custom user defined indicator packages. Building custom user defined studies is clumsy and needlessly burdensome - early '90's technology. It doesn't collect and collate data files for export very well. I would be much better off with CQG - and if someone else was paying for it, a Bloomberg terminal. Bloomberg time and sales data is the best in the business. There's a reason why top shelf trading tools like MatLab and S-Plus have toolboxes for a Bloomberg interface.But eSignal is cheap.

And it has all the exchange supported spreads. And the big reason of course is that I got shamed into using it by my clients - the monthly CQG lease fee is pretty steep. And as part of my course materials, I've engineered some quick and dirty workarounds for volatility, hedge ratios, correlations, and such.And I trade spreads off of price data. And I teach my clients to do the same.

And we set our profit targets and stop-loss levels at the time of trade entry - these specifically would be electronic GTC stop-limit orders with slippage on exchange spreads. I have some difference of opinion with Mav on this particular point but we've known each other for a long time now, I completely respect him and I would venture to say that we agree on 95% of trading related topics. More.If you’re saying that, to use your example, flat price outright CL or NG is less volatile than let’s say a CL or NG butterfly or condor intra market spread that’s just plain wrong on the face of it.

Even more so when you get away from the prompt months. Daylite keygen. Comparing the SPAN margin requirements there is a huge difference. SPAN is going to be much more valid in terms of vol than your anecdotal Mark IV eyeball.Only possible exception might be an intermarket distillate Crack Spread like RB-CL. I have seen from time to time a Crack Spread have a larger trading range than either of the component products - but it’s rare. Quite frankly my clients seldom dabble with the Crack spreads, as the intra markets fit most clients risk tolerance much better.